Creating, Editing, and Deleting Invoices

The Accounts module can add payments against an invoice or bill. This allows you track how much is still owed against each of those items. To create a payment record against an invoice follow the steps below.

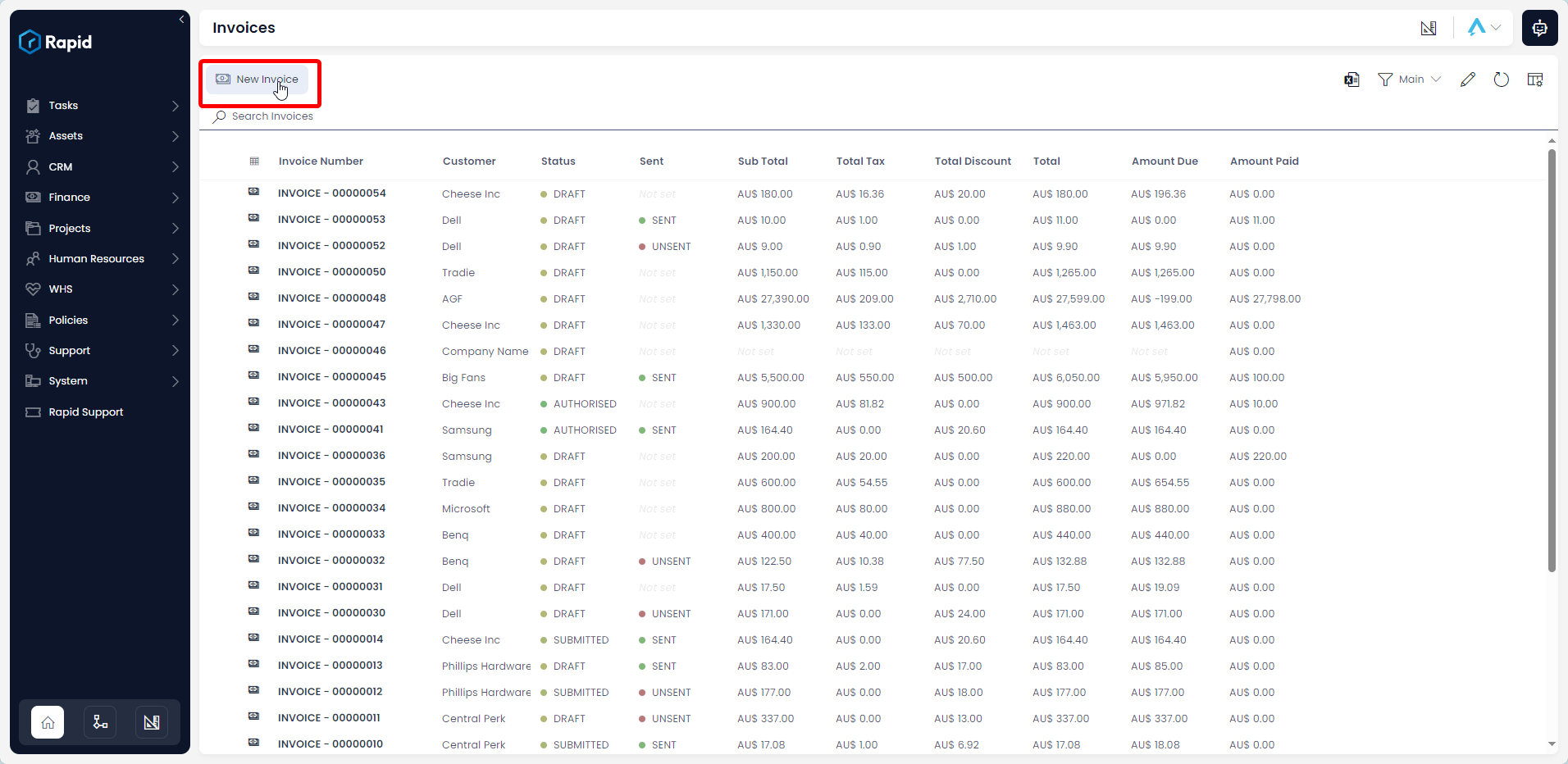

Creating an Invoice

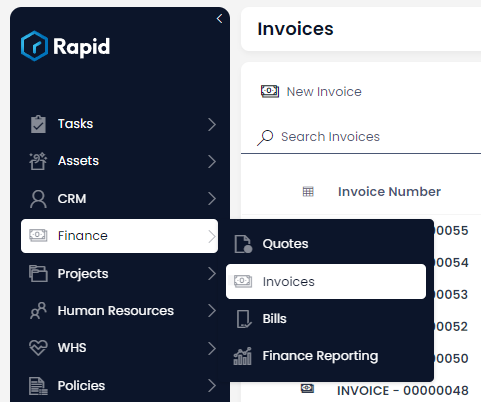

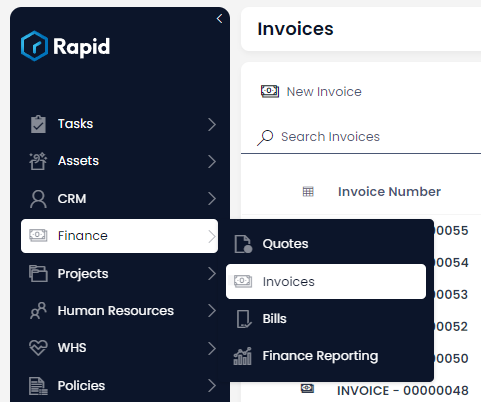

- Navigate to the Finance > Invoices

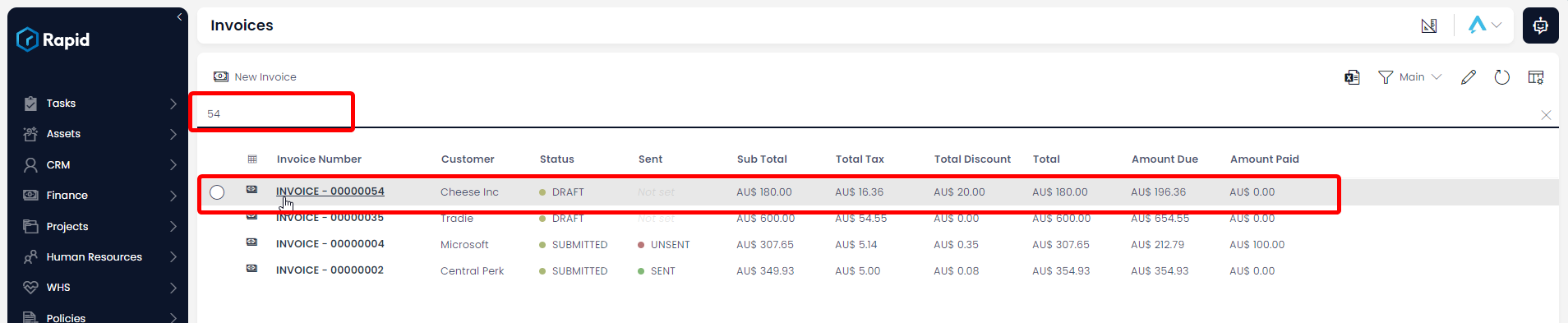

- Locate the invoice you wish to add a payment against either by scrolling through the list or using the search bar.

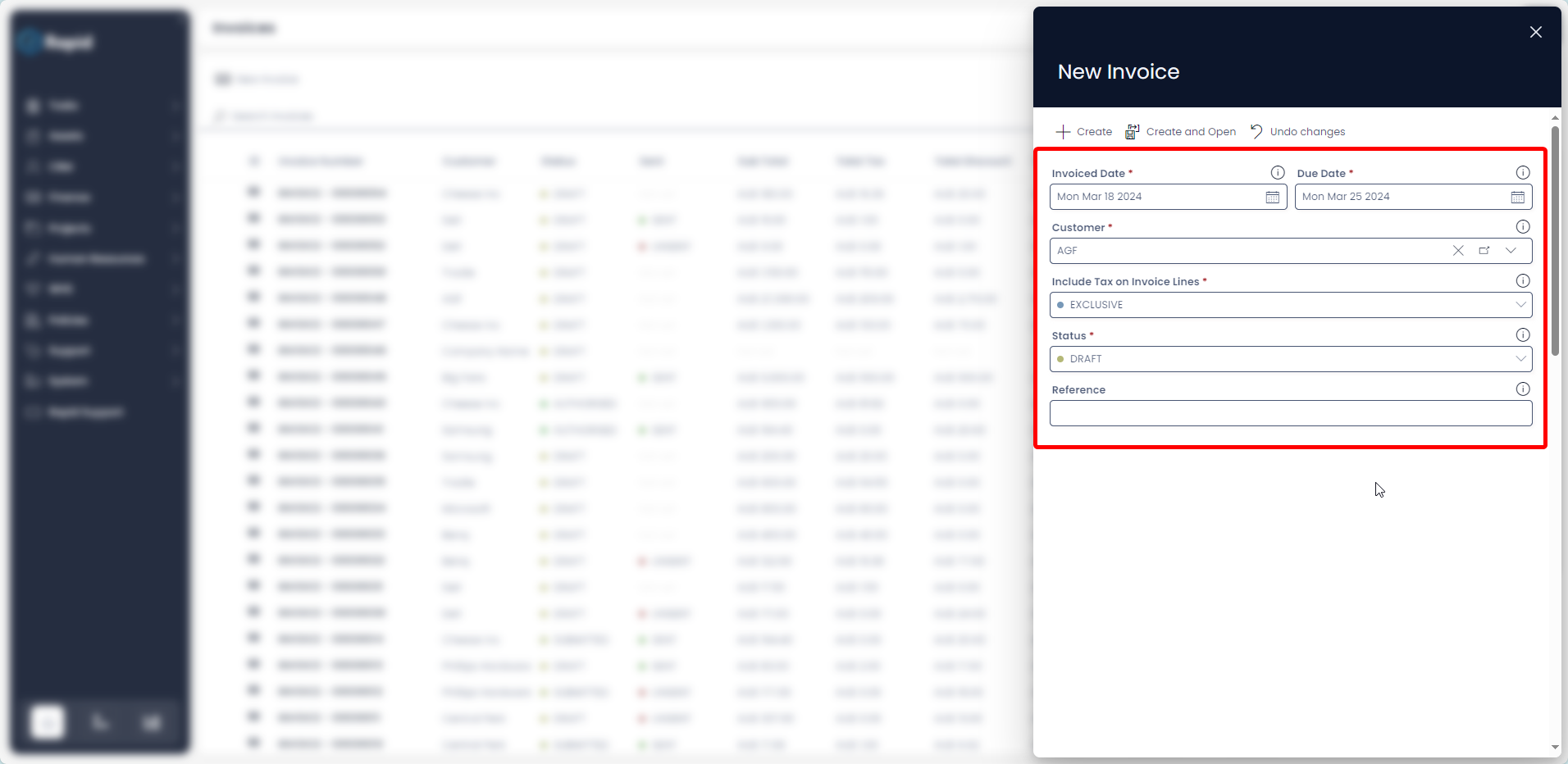

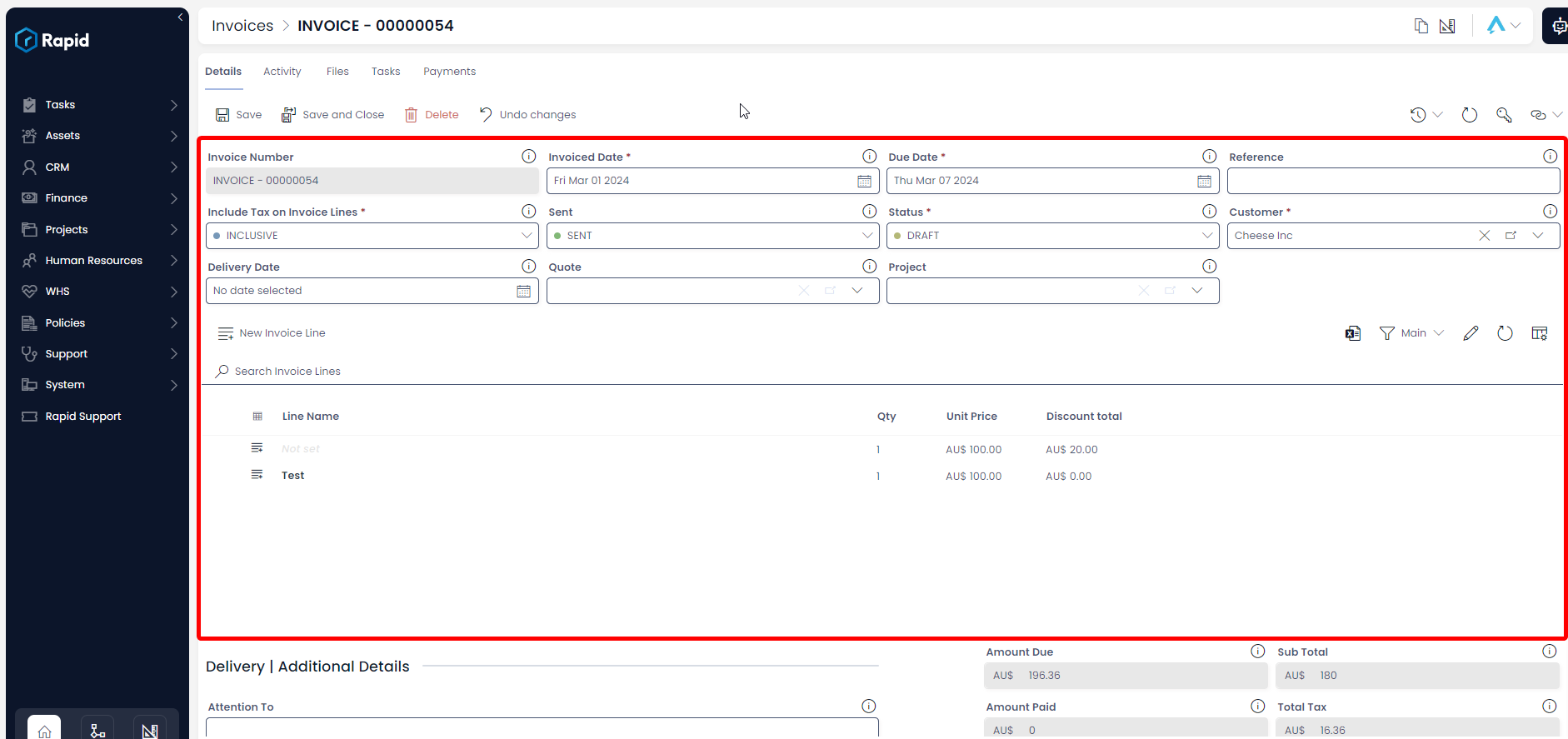

- Enter all relevant details

Require Fields

The following fields are required: Invoiced Date, Due Date, Customer, and Include Tax on Invoice Lines

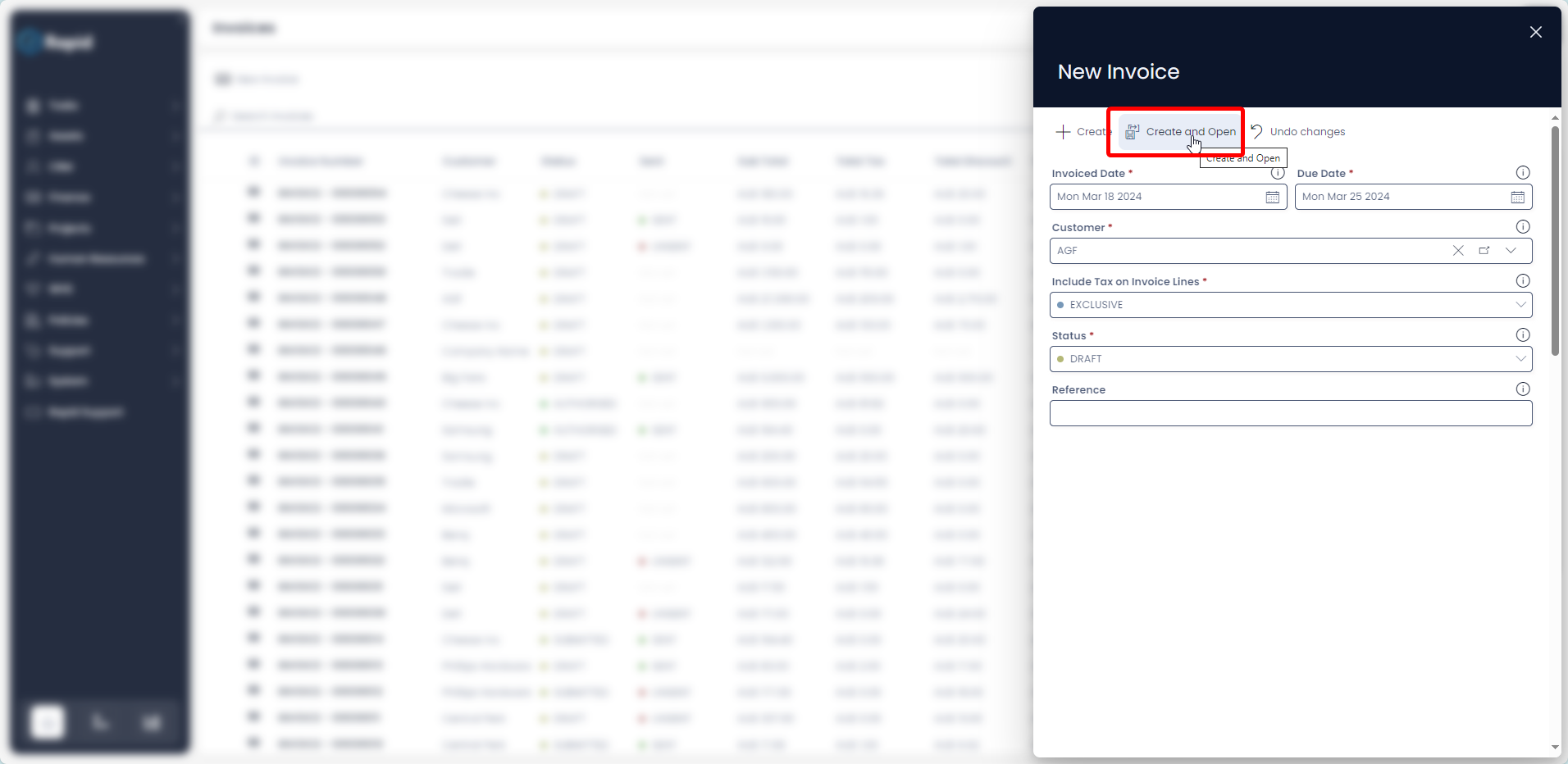

- Click on + Create or Create and Open.

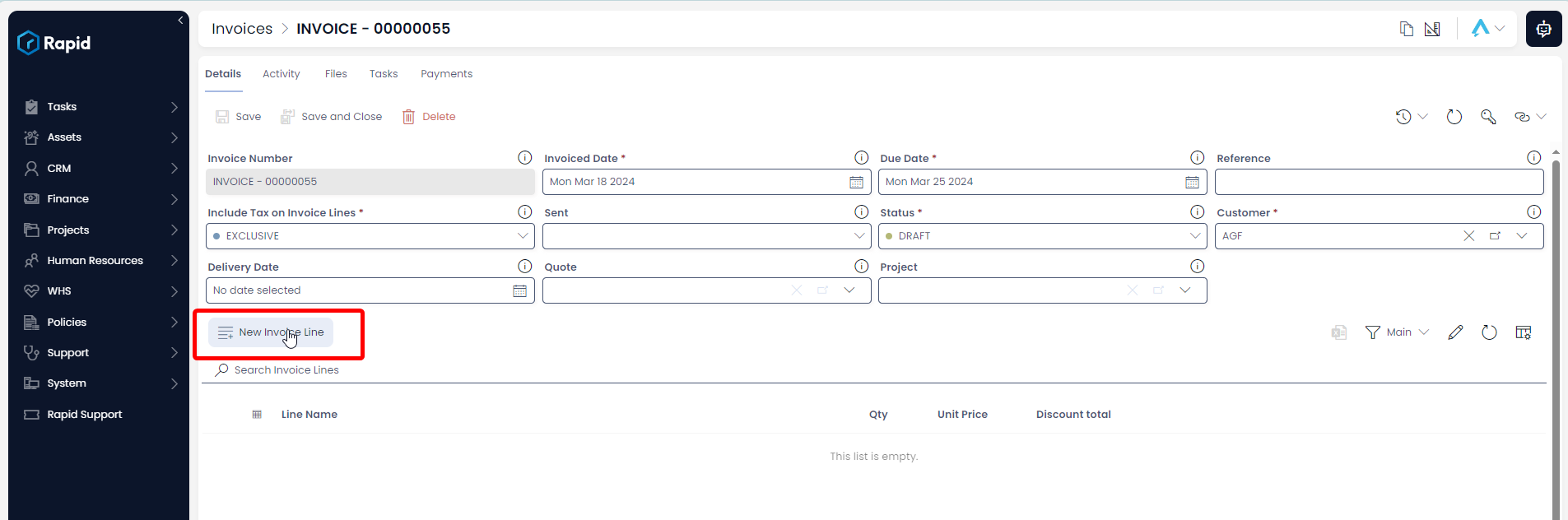

- Halfway down the page Click New Invoice Line (This is where you add all the individual line items)

- Enter all relevant details

Invoice Lines

- The following fields are required: Qty and Unit Price

- By default, there is a 10% Tax rate on invoice items to account for GST, this can be changed to no tax (NA), a fixed tax amount (Fixed), or a fixed tax amount per unit (Fixed per Qty) by adjusting the choice in the Tax Category Field.

- A discount can be applied on each line item as a fixed amount (Discount Amount) or as a percentage (Discount Percentage)

- Click Create

- Follow steps 5 – 7 for each additional invoice line you wish to create.

Editing an Invoice

- Navigate to the Finance > Invoices

- Open the invoice you wish to edit either by scrolling through the list or using the search bar.

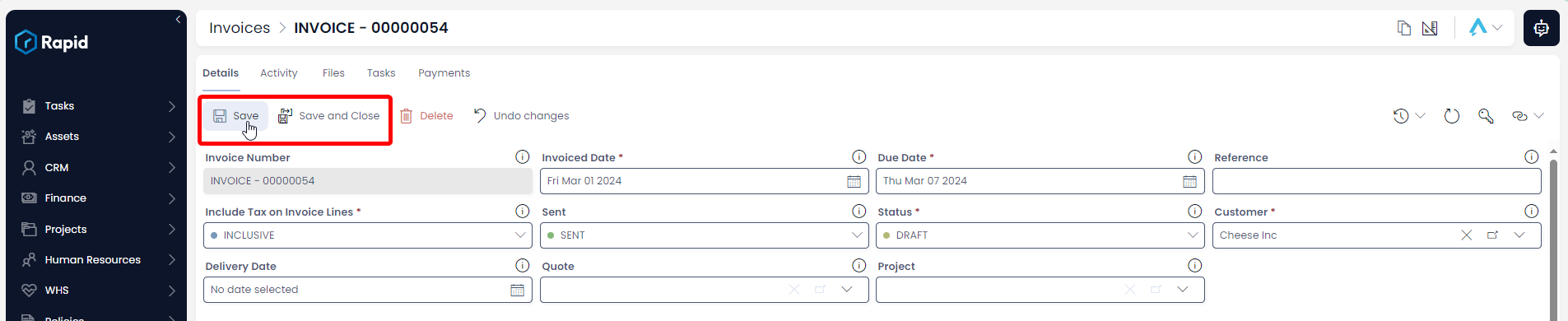

- Edit any relevant fields on the invoice page as needed.

Editing Invoice Lines

To edit an Invoice Line, click on its title, edit the any relevant fields, and then press Save and Close

- Once you have finished editing press Save or Save and Close

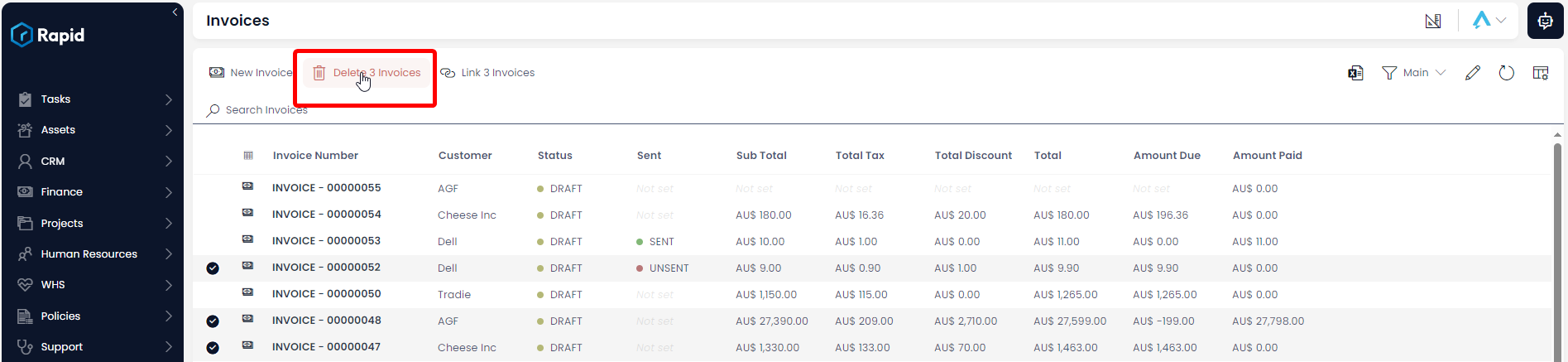

Deleting an Invoice

It is not recommended to delete an Invoice instead, change its status to "VOIDED." This way you can maintain a record of all Invoices.

However, if you need to delete an Invoice due to incorrect data entry or a duplicate entry, you can do so as described below.

-

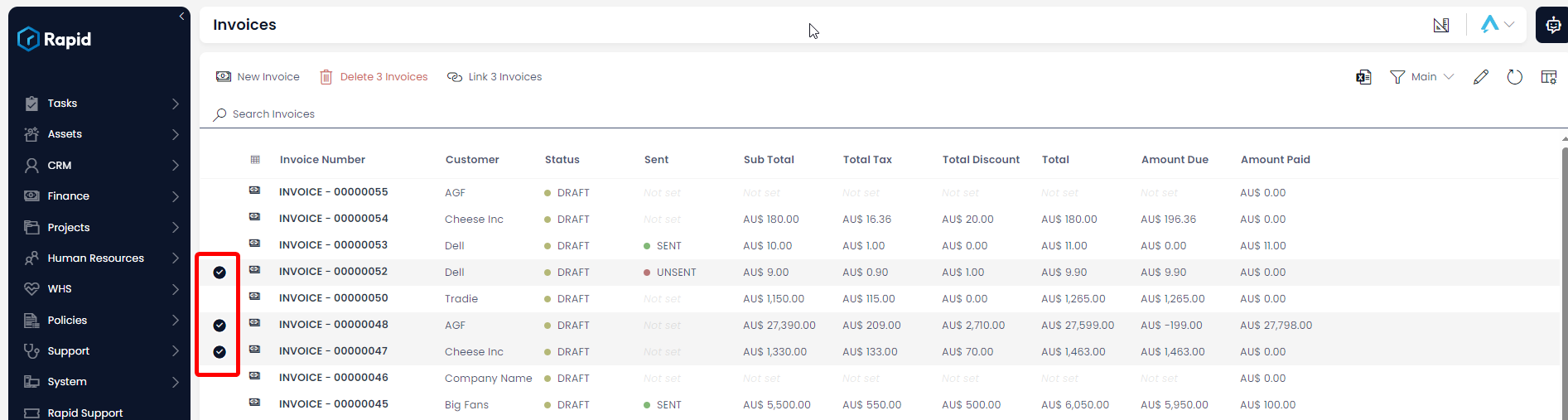

Navigate to the Finance > Invoices

-

Select the Invoices you wish to delete

- Press Delete X Invoices